Disrupting the financial world

GOALS

The Master in Finance and Artificial Intelligence is a program that combines the latest technological breakthroughs and practical financial applications : artificial intelligence, big data analytics, blockchain – with traditional financial skills to train managers who can bridge technical and financial departments.

With companies such as Deloitte and Nexi and other global leaders on the Program Advisory Committee, the board responsible for designing the course, the Master in Finance and Artificial Intelligence is a study path that ensures the acquisition of skills immediately spendable in the business world and the direct contact with companies at the top of the international arena.

This program embarks you on an exciting journey that melds hands-on financial applications with a deep dive into technological advancements.

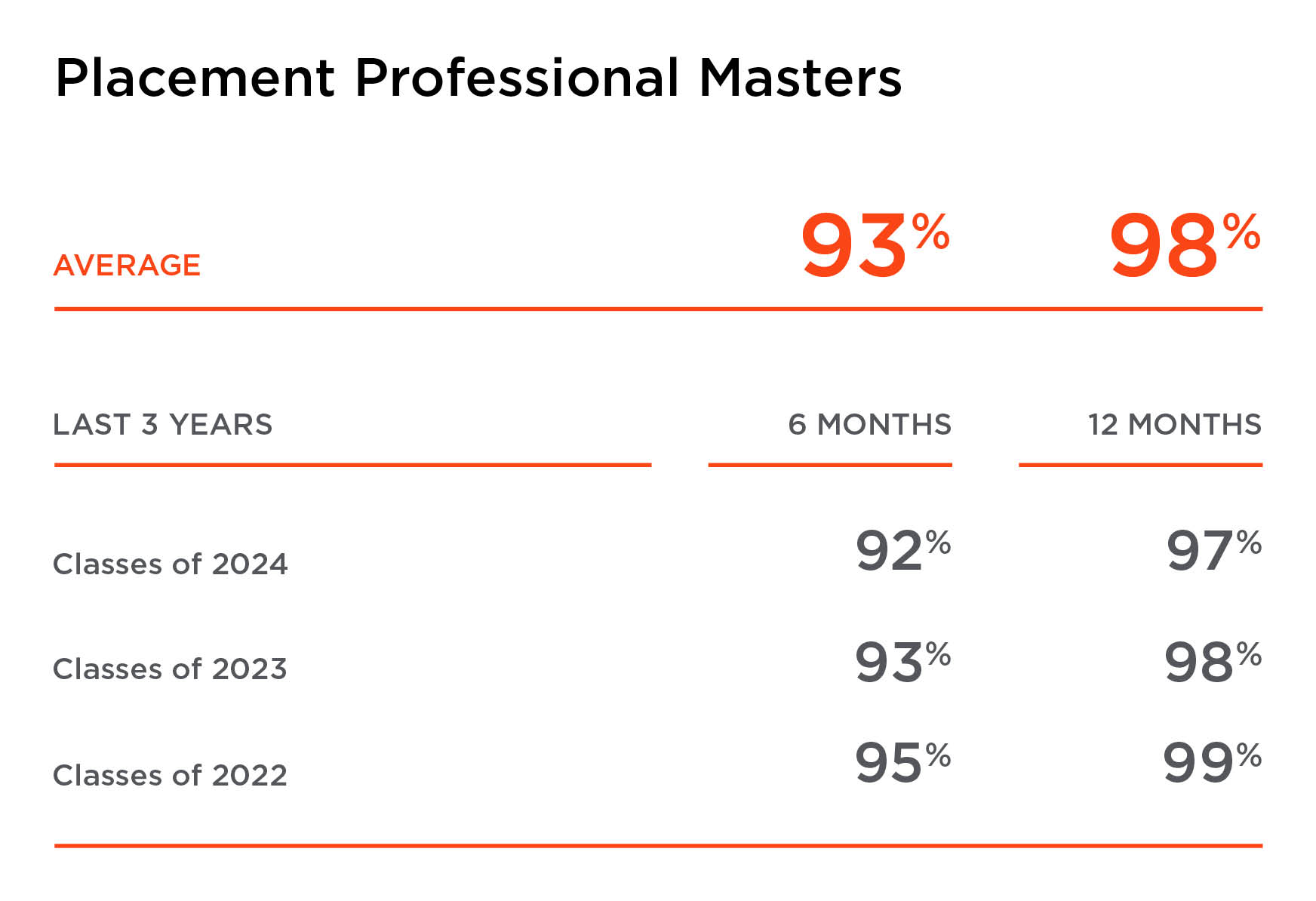

English-language, full-time 12-month, the Master’s program has a six-month placement rate of over 90%: it aims to be a springboard for a career in Finance, with direct entry into the business world thanks to the six-month internship at the end of the course.

WHO IS IT FOR?

Young graduates with excellent knowledge of English passionate about finance, data analysis, and technology. This Master aims to explore the intersection of finance and artificial intelligence. It is ideal for those looking to develop cutting-edge skills in AI-driven financial technologies, innovate within the financial sector, and support the growth of start-ups and businesses in a rapidly evolving digital landscape.

CAREER OPPORTUNITIES

The Master in Finance and Artificial Intelligence is designed to bring tradition and new technologies together. Thanks to BBS’s exclusive and international network, a new generation of managers who are highly trained in both technological and financial skills will be ready to intercept and anticipate new market trends, gaining access to key positions in leading companies in the most various market fields. Some of the positions to aspire to: Financial Analyst Consultant, Strategic Analyst, Investment Analyst, Risk Manager.

If you would like to begin your professional growth in managerial functions, contact the master Program Manager.

SERVICES

Bologna Business School provides student support services included in the tuition fee for the Master.

Programme Advisory Committee:

- Marco Allegretti – Partner, CDP Venture Capital

- Davide Caramico – Head of Americas Business Development, Digital Partnership, Ria Money Transfer

- Alessandra Caroni – Senior Economic Adviser, Her Majesty’s Treasury

- Apoorva Anand Srikkanth – Independent Consultant, Intelsya Limited

- Paolo Gianturco – Senior Partner, FSI Consulting & FStech Leader, Deloitte Italia

- Carlo Giugovaz – Founder & CEO, Supernovae Labs, Finnovaction

- Federico Sforza – Chief Executive Officer & Co-Founder, AideXa

- Piero Crivellaro – Group Head Public and Regulatory Affairs, Nexi Group

- Gabriele Sabato – Co-Founder & CEO, Wiserfunding

Ranking

QS Quacquarelli Symonds is the international network focused on services, analysis and in-depth reports of post-experience and university education, geared toward international mobility and career development. The QS Online MBA Ranking is based on insights from the business world and a methodology that allows programs to be evaluated according to four parameters: Faculty and Teaching, Class Profile, Employability and Class Experience.

Accreditation

Bologna Business School is EQUIS – EFMD Quality Improvement System accredited, one of the most important international quality assessment and continuous improvement systems for Schools of Management and Business Administration.

Emanuele Bajo

Director of Studies

emanuele.bajo@unibo.it

" The increasing availability of financial data and advancements in Artificial Intelligence are reshaping the way financial decisions are made. Generative AI and Large Language Models (LLM) are transforming forecasting, risk assessment, and investment strategies, providing finance professionals with new tools to navigate complexity and uncertainty. This program explores the intersection of finance and AI, equipping students with the analytical skills needed to integrate AI into financial decision-making. By understanding both the potential and the limitations of AI, graduates will be prepared to become finance and AI specialists, applying these technologies effectively in financial management. "

Gabriele Ripellino

" For several decades, technology has been enabling improvement and personalization of financial services and products. Today, even non-Financial Services companies can meet the financial needs of their customers: the concept of Embedded Finance is just the first step toward "invisible" finance. I could not fail to mention the Metaverse, without talk about the new professional roles of two historically distinct worlds, such as technology and finance, that are and will be inescapable. These considerations, the omnipresence of digital finance and the skills that the job market requests, let me choose a Master Course that was a mix of technical, business-oriented and internationality, like the one offered by BBS. Today I'm Engineering Consultant - Industry X-Mobility at Accenture. "

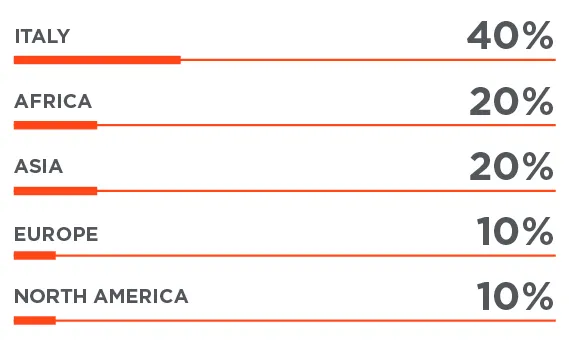

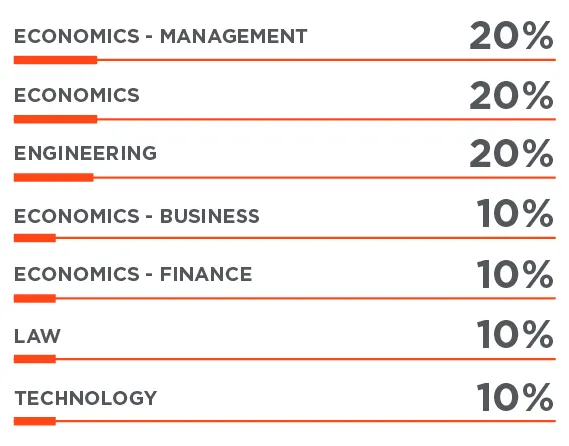

CLASS PROFILE A.Y. 2024/2025

GEOGRAPHICAL ORIGIN

ACADEMIC BACKGROUND

-

25 y.o.

AVERAGE AGE

-

60%

INTERNATIONAL STUDENTS

-

6

COUNTRIES REPRESENTED

-

2%

FEMALE STUDENTS

Structure

The Master in Finance and Artificial Intelligence is a full-time program structured in 1.500 hours of learning activities over 12 months of study, divided into: 400 hours of lecturing, an estimated 600 hours of independent study, and 500 hours of internship.

The structure of the Master is divided into:

- First term: October 2025 – March 2026

- Second term: March 2026– June 2026

- Internship: June 2026 – October 2026

The Master offers a series of pre-courses at the start of the academic schedule: Software programming (Python), data-base and SQL, statistics, finance and accounting.

Following the period of lessons and projects, students will start an internship that can be carried out at companies or agencies in Italy or abroad. This experience allows students to practically apply the theoretical and practical skills acquired during their studies, learning directly from industry pleadres. At the end of the internship, the student will present a “Final Report” to the Director of Studies, containing a description of the activities performed and an analysis of the knowledge gained during the classes period.

For international students, the School offers the opportunity to participate in an Italian language course during the classroom study period.

The Master is held on campus at Bologna Business School. Attendance involves approximately 30 hours of weekly classes, structured to allow time for group work while also ensuring attention to individual students and the management of interpersonal relationships.

COURSES

The role of IT into banking industry is dramatic and innovative at the same time. Banking business models are redesigning by new paradigms: they will impact to strategies and operational perspectives. Banking players need to be into the new picture, supported by new toolkit able to combine the current landscape with new technologies.

Last but not least, ITC firms, media networks, and Big techs companies are the new entrants into financial services arena. FinTech emerging applications are disruptive forces capable to transforming the financial services industry by making transactions faster, cheaper, more secure and transparent. Our banking course delivers a general framework of financial industry and provide some specific knowledge into the disruptive innovation in terms of organization/processes/infrastructures/applications.

Torluccio GiuseppeThis course provides an alternative approach to the study of financial markets: behavioral finance. This approach starts with an observation that the assumptions of investor rationality are overwhelmingly contradicted by both psychological research and empirical evidence. The course gives an introduction into this field and includes results from behavioral finance that help to understand many puzzles in traditional finance. The psychology of dealing with automated financial counterparts/advisors as opposed to humans will also be discussed.

Marinelli NicolettaThe course discusses some relevant themes related to blockchain technologies, cryptocurrencies, ICOs, smart contracts and novel applications that can be built over the blockchain. Bitcoin and novel cryptocurrencies gathered momentum in the last months. More and more investors look with interest at these technologies, while others label them as a dangerous speculative bubble. The truth is that the blockchain, and the alternative implementations of a distributed ledger, represent very innovative technologies, that can be exploited to build novel distributed applications. Moreover, the possibility of creating smart contracts, running on top of the blockchain, permits trusted interactions and agreements among different (and possibly anonymous) parties, without the need for a central authority. This course will illustrate the main principles and conceptual foundations of the blockchain and smart contracts.

Ferretti StefanoToday it is crucial to be able to use data for making better marketing decisions. This is possible by better understanding, predicting and managing customers’ behavior in a landscape where customers and brands (firms) are decision makers. This course focuses on the applied use of various techniques/methods, theories and approaches from marketing literature in practical business cases. In more particular words this means exploring, investigating and predicting behavioral and attitudinal (customer) data to provide data-driven answers to relevant marketing questions

Konus UmutThe digitization of the economy is one of the most relevant issues of our time. The objective of this course is to analyze how digital economy has fundamentally challenged traditional business models and created new business opportunities. We will start with a brief introduction of the digital economy and then analyze the specific business strategies adopted by the different players in this ecosystem, specifically platforms. We will also discuss the implications for public policy and regulation. In particular, we will consider whether new business practices and contracts in the digital economy are beneficial or detrimental to society. Real case studies related to Amazon, Airbnb, Booking.com, Facebook, Google, Uber, and others, will be analyzed.

MantovaniThe course is focused on understanding of the opportunities arisen from digital transformation, in terms of innovative business models for companies and new value for users. Specifically, the course will deepen technology forecasting and technology roadmapping methodologies, applied to emerging digital trends, focusing on Fintech, IoT and Artificial Intelligence.

This course will provide students with an overview of financial markets and the valuation of securities. The course will start presenting the financial system and a taxonomy of the type of securities traded in financial markets. The single asset classes will be then studied, including fixed-income and money market securities, equity instruments, mutual funds, financial derivatives, and hybrids.

Duqi AndiArtificial intelligence (AI) is a discipline whose goal is to realize this dream through the use of a wide variety of techniques, from logic-based symbolic computation to sub-symbolic models inspired by the structure of the brain, such as neural networks. This course will provide an introductory overview of the various existing artificial intelligence techniques, focusing on industrial applications, discussing future challenges and opportunities, and also addressing some of the social, economic, and ethical implications.

Gabbrielli MaurizioRoberto Amadini

The course will provide an introduction to insurance products and insurance business. The aim of the course is to provide students the knowledge of insurance business that is required to apply technology and digital innnovation to this specific sector

Felician LeonardoThe course analyzes the legal framework of the rights of the person when dealing with technology, the protection of personal data, the intersection between person and market in the face of technological platforms and big data, the normative references of GDPR, Digital Service Act and other legal formats with a global vocation. Attention will be paid to the ethical challenge underlying the balance between human intervention and artificial intelligence, to the comparison between legal language and algorithms from the applicability of models to the role of law and regulation in the face of technological change and to the governance and risk management of data.

Some insights concern automated decisions, profiling in the credit and in the insurance sector and the coexistence between incumbents and new entrants in the financial sector.

Machine Learning for Finance course is designed to provide students with a comprehensive understanding of how machine learning techniques can be applied to solve various financial problems. It prepares learners to harness machine learning in areas such as stock price prediction, fraud detection, portfolio management, and high-frequency trading. This course covers both foundational and advanced topics in machine learning, including supervised/unsupervised learning, deep learning, NLP for financial sentiment analysis. Practical Python exercises are included to apply concepts like time series forecasting, algorithmic trading, and big data analysis in finance.

V L Raju ChinthalapatiThe course aims to explore the principles of financial statement analysis. It provides the participants with a framework to understand how businesses’ value and risks are captured in financial statements and price them correctly.

Dal Maso LorenzoMonaco Eleonora

The course deals with financial risk management with an emphasis on the recognition of price risk and on financial risk management tools from the point of view of the company. A significant part of the course is dedicated to the analysis of derivatives and their use in risk management.

Bajo EmanueleThis course emphasizes statistical methods useful for tackling modern-day data analysis problems. A special attention is dedicated to techniques that help managers to make intelligent use of databases by recognizing patterns and making predictions.

The students will develope skills to:

• plan a statistical data analysis process

• manage a data source

• choose the best method to analyze the data

• implement the analysis and interpret the results

Farné Matteo

This course aims at presenting the new emerging trends in the financial industries. Peer-to-peer lending, mobile payments, blockchain-based trading and the impact of new technologies on insurance and regulation are some of the topics that will be discussed through a case-based approach presented by fintech industry leaders.

GianturcoThe “Sustainable Finance and ESG Investing” course explores the integration of environmental, social, and governance (ESG) factors into financial decisions and investments. Students will learn how sustainable investments can generate long-term value, and by the end of the course, they will be able to apply ESG strategies in the financial sector, responding to the growing demand for responsible investments.

The “Business Planning” course provides the necessary skills to develop a solid and strategic business plan. Students will learn how to define clear objectives, analyze the market, develop growth strategies, and manage resources effectively. With a focus on financial analysis, marketing, and risk management, the course prepares participants to create business plans that can drive the success of new ventures or business projects.

Learning approach

The Master’s program is designed to provide a solid theoretical basis, immediately complemented by practical applications, to prepare students to confidently and competently enter the job market. The teaching activities are designed to be practical and experiential, promoting effective learning and comprehensive assessment by the instructors.

The program combines lectures, business case studies, group work and company presentations, offering an interactive approach. Additionally, master lectures delivered by experts from the business, academic, and political areas, along with numerous opportunities to engage with companies through the analysis of case histories, further enrich the learning experience.

Faculty

Faculty members at Bologna Business School work together offering outstanding teaching standards. An international and interdisciplinary approach is guaranteed by a joint team of distinguished national core professors, adjunct, visiting professors, guest speakers and top managers.

-

Emanuele Bajo

Full Professor of Corporate Finance

University of Bologna

-

Furio Camillo

Associate Professor

University of Bologna

-

Lorenzo Dal Maso

Associate Professor of Financial Accounting

University of Bologna

-

Andi Duqi

Professor of Banking and Finance

University of Bologna

-

Matteo Farné

Associate Professor

University of Bologna

-

Leonardo Felician

Professor of Data Science for Insurance

University of Trieste

-

Stefano Ferretti

Associate Professor of Information Technology

University of Bologna

-

Maurizio Gabbrielli

Full Professor of Computer Science

University of Bologna

-

Paolo Gianturco

Senior Partner, Business Operations & FinTech Leader

Deloitte Italia

-

Umut Konus

Professor and Researcher of Marketing Analytics & Digital Business, and Program Director of Bachelor Programs in Business Analytics

University of Amsterdam

-

Paola Manes

Full Professor of Private Law

University of Bologna

-

Andrea Mantovani

Associate Professor

Toulouse Business School

-

Nicoletta Marinelli

Associate Professor of Finance

University of Macerata

-

Azzurra Meoli

Assistant Professor of Business and Management Engineering

University of Bologna

-

Eleonora Monaco

Associate Professor of Accounting

University of Bologna

-

Roberto Amadini

Associate Professor of Computer Science

University of Bologna

-

Giuseppe Torluccio

Full Professor of Banking and Finance

University of Bologna

-

Raju Chinthalapati

Reader in Financial Technologies

University of London

CAREER DEVELOPMENT

The School is fully committed to creating employability, by way of a systematic career service action, constantly focused on matching at best the students’ professional projects with the needs companies have.

The internship is an exceptional springboard, suffice it to say that six months after the end of the full-time masters at Bologna Business School on average 91% of students work in a company.

The BBS Career Service assists and supports students since the very beginning, along a training and professional development path. This is accomplished by organizing a series of workshops, with the aim of providing the fundamental tools and resources to be appropriately prepared for the labor market.

To achieve this goal, students are involved in several workshops, among which we may list:

- Writing a CV and a Cover Letter

- How to create an effective Linkedin profile

- How to prepare for a job interview

In addition to this, thanks to the collaboration with professional career counselors, students receive a customized service, in order to understand their strengths and to build a professional development plan, which will turn out to be helpful when looking for an internship. Here follow some of the activities:

- Initial guidance interviews

- Specific interviews, focused on one’s own career plan

- Continuous support to students with one – to – one sessions

Alumni

Annina Lehmeyer – Germany

Associate IT Consultant, Adesso

Master in Finance and AI (A.Y. 2022/2023)

"This Master provided me with the knowledge and skills to succeed in the next steps in my career. I gained deep insights into financial markets while also developing a strong understanding of artificial intelligence, blockchain and other technologies shaping modern finance. The program’s blend of finance and IT has been especially valuable in my role as an IT Consultant. It enables me to advise my clients effectively and develop innovative solutions that create real value. The hands-on approach and industry-driven curriculum provided me with practical skills that I apply daily. I highly recommend this program to anyone looking to bridge the gap between finance and technology."

Oliver McCallan – Ireland

Institutional Sales Trader, Binance

Master in Finance and AI (A.Y. 2022/2023)

"This Master made interviewing easier, as due to the sheer depth and variety of the classes taught, you are more prepared to discuss a wide range of fintech topics with interviewers. I came out of this Master not only better versed in subjects like derivatives & banking, but also with actionable knowledge in the growing fields of machine learning and artificial intelligence - which in employers' eyes, is a real strength. For prospective students, I strongly recommend making the most of BBS' Career Service. They are proactive and well connected with companies both in Italy and internationally. If you have a creative idea for a class project, don’t hesitate to go for it - the professors are very supportive. In today’s job market, showing initiative is more important than ever, and this Master is a great place to develop and demonstrate that ability."

Gabriele Ripellino – Italy

Engineering Consultant - Industry X-Mobility, Accenture

Master in Finance and AI (A.Y. 2021/2022)

"For several decades, technology has been enabling improvement and personalization of financial services and products. Today, even non-Financial Services companies can meet the financial needs of their customers: the concept of Embedded Finance is just the first step toward "invisible" finance. I could not fail to mention the Metaverse, without talk about the new professional roles of two historically distinct worlds, such as technology and finance, that are and will be inescapable. These considerations, the omnipresence of digital finance and the skills that the job market requests, let me choose a Master Course that was a mix of technical, business-oriented and internationality, like the one offered by BBS"

Federico Costa – Italy

Senior Consultant, Deloitte

Master in Finance and AI (A.Y. 2019/2020)

"The Master provides you with managerial skills, complete and exhaustive knowledge of the financial world, and, through workshops and group works, provides excellent technical skills in data analysis. When you join the BBS you are aware that you are going beyond mere specialized university training. You become part of an international community made up of prepared and ambitious people. Based on the results obtained, I can certainly ensure that this Master was a fundamental investment for my personal and professional growth. "

Wiktor Oleksy – Poland

Business Analyst, CRIF

Master in Finance and AI (A.Y. 2019/2020)

"It is difficult to quantify the range of challenges that I have experienced and completed during the Master in Finance and Fintech. When I was signing up for this specialized course I had a certain idea of financial technology concepts, but only after finishing the Master I faced a reality check, and understood how broad the Fintech world is. I also learnt how interconnected it is with other scientific areas and phenomena. Learning that, and also thanks to the BBS career network, I was able to find an internship and then work full time at an Italian company in the industry. "

COMPANIES

The goal of the Career Service is also to allow students to connect with national and international companies. Over the years, Bologna Business School has managed to establish a wide-ranging network and a sound partnership with leading companies in Italy, thanks to a personalized approach, based on each company’s needs. The collaboration features the following activities:

- Sending CV Books

- Sharing internship opportunities

- Company presentations

- Career days

- Project works

- In-class activities with case studies presented by Managers and/or HR professionals

Moreover, companies support the Master in Finance and Fintech with scholarships, professional opportunities, career fairs and company presentations.

The companies that worked with us in 2023/2024 are:

ACCENTURE AMPLIFON AUTOCLUB BAKER HUGHES BE SHAPING THE FUTURE CAMPARI CHAMPION EUROPE CRIF ELI LILLY EY GENERALI INTESA SAN PAOLO INTUITECH MANAGEMENT SOLUTIONS MEDIOLANUM NTT DATA PHILIP MORRIS INTERNATIONAL PRIMA SIDERA PWC SCS CONSULTING SUPERNOVAE LABS TAAK TULIPS UNIDO UNIPOLSAI VERSACE

FEES

The tuition fees for the Master is 14,800 euro (VAT free) to be paid in three installments:

- First installment: 1,850 euros (by the enrollment deadline of the round you applied for)

- Second installment: 7,000 euros (November 2025)

- Third installment: 5,950 euros (February 2026)

The fee includes participation in the Master, all the study material available through the online platform, and access to the services and facilities of Bologna Business School. Furthermore, the fee gives participants the right to take advantage of the supporting activities of the School, such as the language courses and the master lectures by invitation. Free parking is also available within BBS Campus.

Additionally, with the Student Card of the University of Bologna, students have access to all of the university facilities, including over 100 libraries, digital resources and study halls (including databases and online subscriptions) and all university student related discount offers. More information is available on the site of the University of Bologna: http://www.unibo.it/it/servizi-e-opportunita

HONOR LOAN

For more information on honor loan, contact us by email: finance@bbs.unibo.it

SCHOLARSHIPS

At Bologna Business School, we believe in the merit and potential of our students. That’s why, for each round of selection, we offer partial scholarships of €4,000 and €6,000 to candidates who stand out for their academic background, professional experience, motivation, and career aspirations.

Scholarships are awarded by the Admissions Committee, following the selection process, to the most deserving candidates who are ready to make the most of a learning experience that combines academic quality, links with a strong business newtork, and an international outlook.

Please note that full scholarships are not available and that financial aid programs from the University of Bologna (i.e. DSU, ER.GO) are not eligible for the Professional Masters held at Bologna Business School.

REQUIREMENTS

In order to be admitted to the Master’s course you must have:

- Bachelor’s degree (obtained by the enrollment deadline of the round of selection you applied for)

- Excellent level of English

The admission to the Master is subject to the positive evaluation of the selection test in line with the number of places available. The selection process, held online, consists of one Aptitude Test and one English Language Test, both prerequisites to be admitted to the motivational interview in English.

APPLICATION PROCESS

1. Register on “Studenti Online” by connecting to the site studenti.unibo.it

2. Select: First Level Master >Master in Finance

3. Pay the participation fee for the selection (60 euro)

4. Upload the required documents online:

- Curriculum Vitae in English

- Motivational letter in English

- Letters of reference in English (optional)

- Photograph of recognition

- If available, a GMAT/GRE certificate with a score above 550 (GMAT) or equivalent (GRE). Applicants uploading this certificate are exempted from the written aptitude test as part of the admission process

- If available, an English language certificate (TOEFL, IELTS or CAMBRIDGE) attesting a minimum English level of B2 in the European framework. Applicants uploading this certificate are exempted from the written English test as part of the admission process

- For degrees obtained in Italy: Self-certification of Bachelor’s degree with details of exams taken and relative grades

- For degrees obtained abroad: Dichiarazione di Valore (to be requested at the Italian Embassy in the country where the degree was obtained) or Diploma Supplement (to be requested at the university where the degree was obtained). In the event that the candidate is unable to obtain the Dichiarazione di Valore or Diploma Supplement at the time of enrollment, he/she may temporarily replace it with a Conditional Enrollment Form, which will be sent at finance@bbs.unibo.it

For further guidance, candidates who obtained a bachelor’s degree abroad are encouraged to check the page below: https://www.unibo.it/en/teaching/enrolment-transfer-and-final-examination/declaration-of-value-translation-and-legalization

For information regarding the selection process, please download the Call for Application and the related attachements.

CALL_PROFESSIONAL MASTERS CALL_MASTER IN FINANCE INSTRUCTIONS TO APPLY TO THE SELECTION CONCENTRATION FORM CONDITIONAL ENROLLMENT