Shaping the Future of Finance

GOALS

The Master in Entrepreneurial Finance is an ideal program for those aspiring to become leaders in the finance sector for innovation and startups. Students will acquire practical and strategic skills to support business growth, exploring key areas such as venture capital, innovation financing, and financial resource management in dynamic and high-volatility environments.

An exclusive opportunity to dive into the heart of entrepreneurship and the most challenging financial issues.

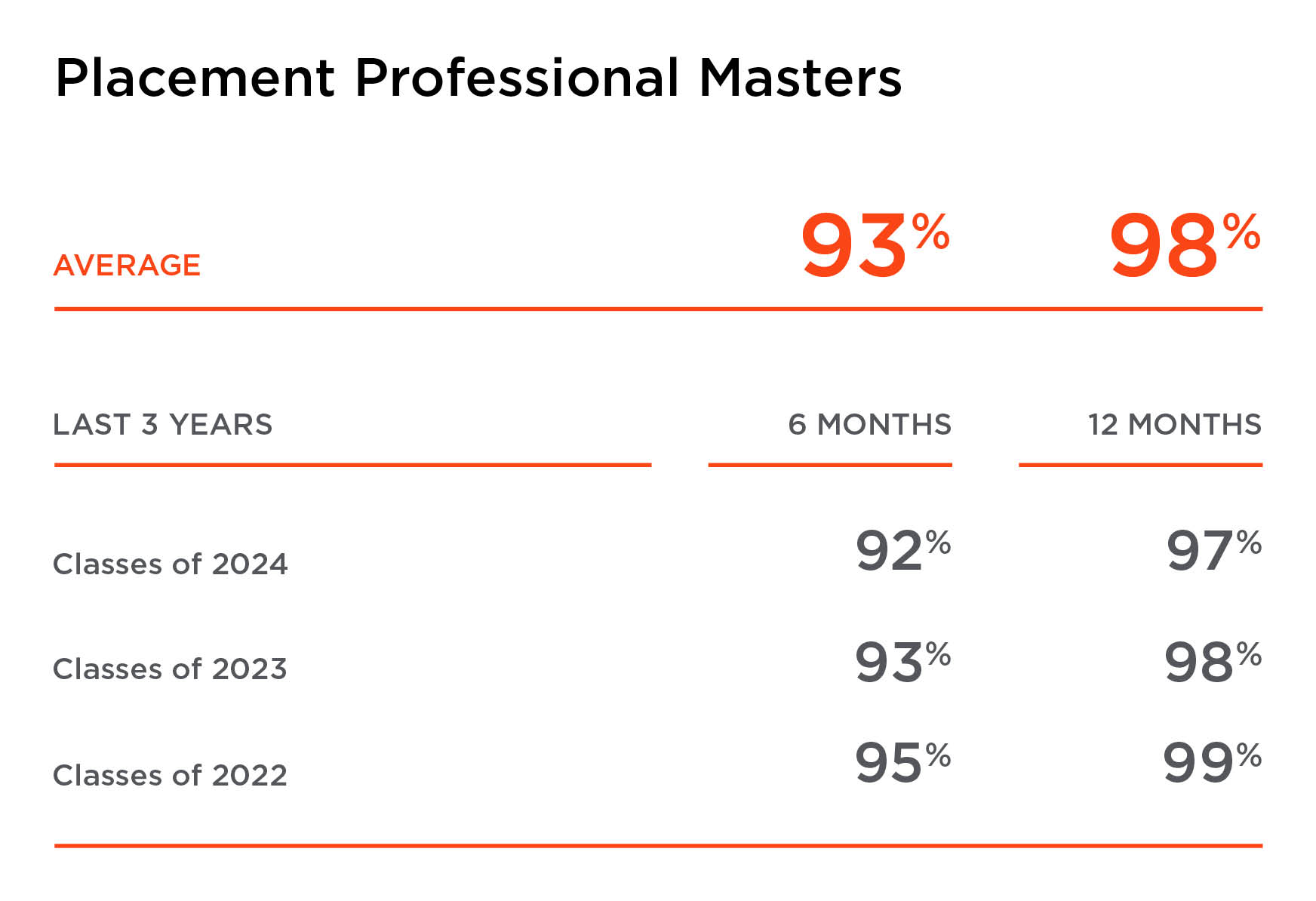

Taught in English, full-time for 12 months, the Master has a placement rate above 90% at six months: it is designed as a stepping stone for a career in finance, providing direct access to the job market through a six-month internship at the end of the program.

WHO IS IT FOR?

Young graduates in economics, finance, engineering, management, or related fields, with a high level of English language proficiency, interested in tackling new financial technologies and supporting innovation and start-up.

CAREER OPPORTUNITIES

The Master provides the necessary skills to support the growth and development of innovative businesses and startups. Participants will acquire strategic abilities to work in venture capital funds, as private equity analysts, innovation and fundraising consultants, or financial managers in companies with high growth potential. Additionally, they will be able to develop effective business plans and evaluate investment opportunities with a targeted and professional approach. Some of the job positions to aim for: Financial Analyst Consultant, Strategic Analyst, Investment Analyst, Risk Manager, Underwriting Manager.

To begin your professional growth journey as a manager, contact the Master’s Program Manager.

SERVICES

Bologna Business School provides student support services included in the tuition fee for the Master.

Programme Advisory Committee:

- Marco Allegretti – Partner, CDP Venture Capital

- Davide Caramico – Head of Americas Business Development, Digital Partnership, Ria Money Transfer

- Alessandra Caroni – Senior Economic Adviser, Her Majesty’s Treasury

- Apoorva Anand Srikkanth – Independent Consultant, Intelsya Limited

- Paolo Gianturco – Senior Partner, FSI Consulting & FStech Leader, Deloitte Italia

- Carlo Giugovaz – Founder & CEO, Supernovae Labs, Finnovaction

- Federico Sforza – Chief Executive Officer & Co-Founder, AideXa

- Piero Crivellaro – Group Head Public and Regulatory Affairs, Nexi Group

- Gabriele Sabato – Co-Founder & CEO, Wiserfunding

Ranking

QS Quacquarelli Symonds is the international network focused on services, analysis and in-depth reports of post-experience and university education, geared toward international mobility and career development. The QS Online MBA Ranking is based on insights from the business world and a methodology that allows programs to be evaluated according to four parameters: Faculty and Teaching, Class Profile, Employability and Class Experience.

Accreditation

Bologna Business School is EQUIS – EFMD Quality Improvement System accredited, one of the most important international quality assessment and continuous improvement systems for Schools of Management and Business Administration.

Emanuele Bajo

Director of Studies

emanuele.bajo@unibo.it

" The rapid advancements in Artificial Intelligence and digital technologies have created unprecedented opportunities for entrepreneurial ventures in the financial sector. From innovative funding models to sophisticated data-driven decision-making, these technologies are transforming the way businesses are financed and managed. This program equips students with the skills and knowledge to navigate the evolving financial landscape while learning how to craft compelling business ideas, pitch them effectively to investors, and bring them to market. By fostering a deep understanding of the intersection between technology and finance, graduates will be prepared to identify opportunities, develop innovative solutions, and drive the growth of entrepreneurial ventures in an increasingly complex market. "

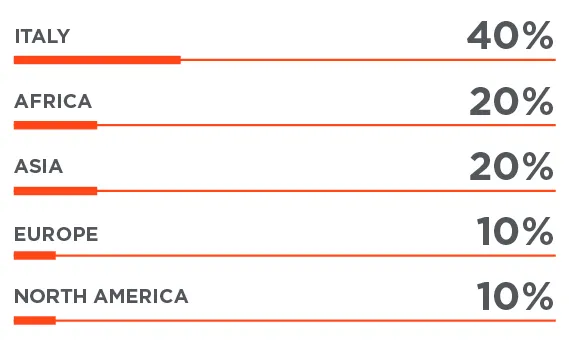

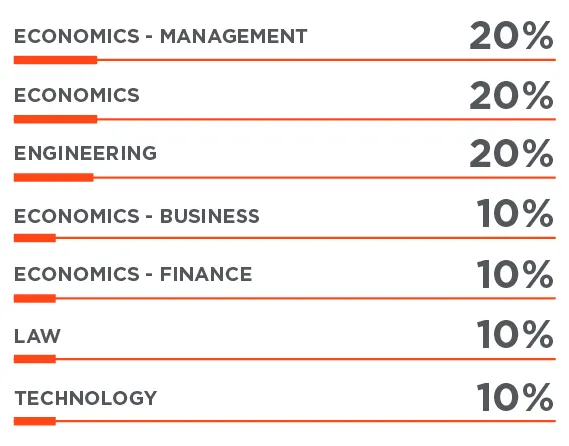

CLASS PROFILE 2024/2025

GEOGRAPHICAL ORIGIN

ACADEMIC BACKGROUND

-

25 y.o.

AVERAGE AGE

-

60%

INTERNATIONAL STUDENTS

-

6

COUNTRIES REPRESENTED

-

2%

FEMALE STUDENTS

Structure

The Master in Entrepeneurial Finance is a full-time program structured in 1.500 hours of learning activities over 12 months of study, divided into: 400 hours of lecturing, an estimated 600 hours of independent study, and 500 hours of internship.

The structure of the Master is divided into:

- First term: October 2025 – March 2026

- Second term: March 2026 – June 2026

- Internship: June 2026 – October 2026

The Master offers a series of pre-courses at the start of the academic schedule: Software programming (Python), data-base and SQL, statistics, finance and accounting.

Following the period of lessons and projects, students will start an internship that can be carried out at companies or agencies in Italy or abroad. This experience allows students to practically apply the theoretical and practical skills acquired during their studies, learning directly from industry pleadres. At the end of the internship, the student will present a “Final Report” to the Director of Studies, containing a description of the activities performed and an analysis of the knowledge gained during the classes period.

For international students, the School offers the opportunity to participate in an Italian language course during the classroom study period.

The Master is held on campus at Bologna Business School. Attendance involves approximately 30 hours of weekly classes, structured to allow time for group work while also ensuring attention to individual students and the management of interpersonal relationships.

Students who are interested can also choose to take an extracurricular course of Italian.

COURSES

Al giorno d’oggi è fondamentale poter utilizzare i dati per prendere decisioni di marketing migliori. Ciò è possibile grazie a una migliore comprensione, previsione e gestione del comportamento dei clienti in un panorama in cui i clienti stessi e i marchi (le aziende) sono i responsabili delle decisioni. Questo corso si concentra sull’uso applicato di varie tecniche/metodi, teorie e approcci della letteratura di marketing in casi aziendali pratici. In parole più particolari, ciò significa esplorare, indagare e prevedere i dati comportamentali e attitudinali (dei clienti) per fornire risposte guidate dai dati a domande di mercato rilevanti.

Il corso è focalizzato sulla comprensione delle opportunità derivanti dall’innovazione e dalla trasformazione digitale, in termini di modelli di business innovativi per le aziende e di nuovo valore per gli utenti. In particolare, il corso approfondirà i modelli di business e le piattaforme applicate ai trend digitali emergenti. Il corso combina lezioni, discussioni di casi, attività di gruppo e individuali.

The course analyzes the legal framework of the rights of the person when dealing with technology, the protection of personal data, the intersection between person and market in the face of technological platforms and big data, the normative references of GDPR, Digital Service Act and other legal formats with a global vocation. Attention will be paid to the ethical challenge underlying the balance between human intervention and artificial intelligence, to the comparison between legal language and algorithms from the applicability of models to the role of law and regulation in the face of technological change and to the governance and risk management of data.

Some insights concern automated decisions, profiling in the credit and in the insurance sector and the coexistence between incumbents and new entrants in the financial sector.

The course aims to explore the principles of financial statement analysis. It provides the participants with a framework to understand how businesses’ value and risks are captured in financial statements and price them correctly.

Dal Maso LorenzoMonaco Eleonora

La digitalizzazione dell’economia è uno dei problemi più rilevanti del nostro tempo. L’obiettivo di questo corso è di analizzare come l’economia digitale abbia sostanzialmente sfidato i modelli di business tradizionali e creato nuove opportunità di business.Dopo una breve introduzione dell’economia digitale, verranno presentate le strategie di business specifiche adottate dai diversi attori in questo ecosistema, in particolare le piattaforme. Inoltre, verranno presentate le implicazioni per le politiche e la regolamentazione pubbliche. In particolare, si discuterà rigurardo le nuove pratiche commerciali e i contratti nell’economia digitale e il loro impatto sulla società. Verranno analizzati casi di studio concreti relativi ad Amazon, Airbnb, Booking.com, Facebook, Google, Uber e altri.

This course emphasizes statistical methods useful for tackling modern-day data analysis problems. A special attention is dedicated to techniques that help managers to make intelligent use of databases by recognizing patterns and making predictions.

The students will develope skills to:

• plan a statistical data analysis process

• manage a data source

• choose the best method to analyze the data

• implement the analysis and interpret the results

Farné Matteo

Questo corso fornirà agli studenti una panoramica dei mercati finanziari e una introduzione sulla valutazione degli strumenti finanziari. Il corso inizierà con la presentazione del sistema finanziario e della tassonomia dei titoli scambiati nei mercati finanziari. Verranno quindi studiate le singole classi di attività, compresi titoli a reddito fisso e del mercato monetario, strumenti azionari, fondi comuni di investimento, derivati finanziari e ibridi.

The course deals with financial risk management with an emphasis on the recognition of price risk and on financial risk management tools from the point of view of the company. A significant part of the course is dedicated to the analysis of derivatives and their use in risk management.

Bajo EmanueleThe role of IT into banking industry is dramatic and innovative at the same time. Banking business models are redesigning by new paradigms: they will impact to strategies and operational perspectives. Banking players need to be into the new picture, supported by new toolkit able to combine the current landscape with new technologies.

Last but not least, ITC firms, media networks, and Big techs companies are the new entrants into financial services arena. FinTech emerging applications are disruptive forces capable to transforming the financial services industry by making transactions faster, cheaper, more secure and transparent. Our banking course delivers a general framework of financial industry and provide some specific knowledge into the disruptive innovation in terms of organization/processes/infrastructures/applications.

Torluccio GiuseppeQuesto corso propone un approccio alternativo allo studio dei mercati finanziari: la finanza comportamentale. Questo approccio parte dal presupposto che il principio della razionalità degli investitori è contraddetta sia dalla ricerca psicologica che dall’evidenza empirica. Il corso offre un’introduzione di questo argomento e include i risultati della finanza comportamentale per aiutare a comprendere molte questioni irrisolte della finanza tradizionale. Gli aspetti psicologici legati al confronto rispetto a controparti/consulenti finanziari automatizzati, anziché umani, saranno discussi all’interno del corso.

Il corso si concentra sugli aspetti finanziari seguendo il ciclo di vita di iniziative innovative a partire dalla loro nascita. Queste giovani imprese di solito richiedono sostanziali finanziamenti esterni nelle prime fasi per creare occupazione, crescita, contributi sociali ed entrate fiscali nel loro futuro. I finanziamenti bancari non sono disponibili per queste iniziative e, pertanto, tutti i fondi devono essere raccolti da altre fonti, ad es. Da amici, familiari, business angels oppure da intermediari finanziari professionali, i cosiddetti fondi di venture capital e private equity. Oltre a questi canali tradizionali, le imprese possono raccogliere fondi utilizzando le piattaforme digitali (crowdfunding) o le tecnologie basate su blockchain (ICO).

The “Sustainable Finance and ESG Investing” course explores the integration of environmental, social, and governance (ESG) factors into financial decisions and investments. Students will learn how sustainable investments can generate long-term value, and by the end of the course, they will be able to apply ESG strategies in the financial sector, responding to the growing demand for responsible investments.

The “Business Planning” course provides the necessary skills to develop a solid and strategic business plan. Students will learn how to define clear objectives, analyze the market, develop growth strategies, and manage resources effectively. With a focus on financial analysis, marketing, and risk management, the course prepares participants to create business plans that can drive the success of new ventures or business projects.

The course provides a framework for understanding and analyzing investment and financial decisions of corporations. Lectures and readings provide an introduction to present value techniques, capital budgeting, capital structure decisions, corporate cost of capital, initial and seasoned equity offerings and an introduction to corporate risk management. Most of the topics presented during the course will also be analyzed and studied using a case study approach.

Bajo EmanueleThis course examines the rules and processes through which firms are controlled and managed. At the heart of corporate governance is the agency problem: Managers, who control corporate resources, may prioritize their own interests rather than maximizing returns for the providers of capital. What are the consequences for the firm’s value if they fail to act in investors’ interests? What mechanisms and incentives ensure they do? The course explores governance structures across different ownership models, with a focus on Europe, where large shareholders play a dominant role.

Barbi MassimilianoLearning approach

The Master’s program is designed to provide a solid theoretical basis, immediately complemented by practical applications, to prepare students to confidently and competently enter the job market. The teaching activities are designed to be practical and experiential, promoting effective learning and comprehensive assessment by the instructors.

The program combines lectures, business case studies, group work and company presentations, offering an interactive approach. Additionally, master lectures delivered by experts from the business, academic, and political areas, along with numerous opportunities to engage with companies through the analysis of case histories, further enrich the learning experience.

Faculty

Faculty members at Bologna Business School work together offering outstanding teaching standards. An international and interdisciplinary approach is guaranteed by a joint team of distinguished national core professors, adjunct, visiting professors, guest speakers and top managers.

-

Emanuele Bajo

Full Professor of Corporate Finance

University of Bologna

-

Massimiliano Barbi

Professor of Corporate Finance

University of Bologna

-

Furio Camillo

Associate Professor

University of Bologna

-

Lorenzo Dal Maso

Associate Professor of Financial Accounting

University of Bologna

-

Matteo Farné

Associate Professor

University of Bologna

-

Paola Manes

Full Professor of Private Law

University of Bologna

-

Eleonora Monaco

Associate Professor of Accounting

University of Bologna

-

Giuseppe Torluccio

Full Professor of Banking and Finance

University of Bologna

CAREER DEVELOPMENT

The School is fully committed to creating employability, by way of a systematic career service action, constantly focused on matching at best the students’ professional projects with the needs companies have.

The internship is an exceptional springboard, suffice it to say that six months after the end of the full-time masters at Bologna Business School on average 91% of students work in a company.

The BBS Career Service assists and supports students since the very beginning, along a training and professional development path. This is accomplished by organizing a series of workshops, with the aim of providing the fundamental tools and resources to be appropriately prepared for the labor market.

To achieve this goal, students are involved in several workshops, among which we may list:

- Writing a CV and a Cover Letter

- How to create an effective Linkedin profile

- How to prepare for a job interview

In addition to this, thanks to the collaboration with professional career counselors, students receive a customized service, in order to understand their strengths and to build a professional development plan, which will turn out to be helpful when looking for an internship. Here follow some of the activities:

- Initial guidance interviews

- Specific interviews, focused on one’s own career plan

- Continuous support to students with one – to – one session

COMPANIES

The goal of the Career Service is also to allow students to connect with national and international companies. Over the years, Bologna Business School has managed to establish a wide-ranging network and a sound partnership with leading companies in Italy, thanks to a personalized approach, based on each company’s needs. The collaboration features the following activities:

- Sending CV Books

- Sharing internship opportunities

- Company presentations

- Career days

- Project works

- In-class activities with case studies presented by Managers and/or HR professionals

Moreover, companies support the Master in Finance with scholarships, professional opportunities, career fairs and company presentations.

The companies that worked with us in 2023/2024 are:

ACCENTURE AMPLIFON AUTOCLUB BAKER HUGHES BE SHAPING THE FUTURE CAMPARI CHAMPION EUROPE CRIF ELI LILLY EY GENERALI INTESA SAN PAOLO INTUITECH MANAGEMENT SOLUTIONS MEDIOLANUM NTT DATA PHILIP MORRIS INTERNATIONAL PRIMA SIDERA PWC SCS CONSULTING SUPERNOVAE LABS TAAK TULIPS UNIDO UNIPOLSAI VERSACE

FEES

The tuition fees for the Master is 14,800 euro (VAT free) to be paid in three installments:

- First installment: 1,850 euros (by the enrollment deadline of the round you applied for)

- Second installment: 7,000 euros (November 2025)

- Third installment: 5,950 euros (February 2026)

The fee includes participation in the Master, all the study material available through the online platform, and access to the services and facilities of Bologna Business School. Furthermore, the fee gives participants the right to take advantage of the supporting activities of the School, such as the language courses and the master lectures by invitation. Free parking is also available within BBS Campus.

Additionally, with the Student Card of the University of Bologna, students have access to all of the university facilities, including over 100 libraries, digital resources and study halls (including databases and online subscriptions) and all university student related discount offers. More information is available on the site of the University of Bologna: http://www.unibo.it/it/servizi-e-opportunita

HONOR LOAN

For more information on honor loan, contact us by email: finance@bbs.unibo.it

SCHOLARSHIPS

At Bologna Business School, we believe in the merit and potential of our students. That’s why, for each round of selection, we offer partial scholarships of €4,000 and €6,000 to candidates who stand out for their academic background, professional experience, motivation, and career aspirations.

Scholarships are awarded by the Admissions Committee, following the selection process, to the most deserving candidates who are ready to make the most of a learning experience that combines academic quality, links with a strong business newtork, and an international outlook.

Please note that full scholarships are not available and that financial aid programs from the University of Bologna (i.e. DSU, ER.GO) are not eligible for the Professional Masters held at Bologna Business School.

REQUIREMENTS

In order to be admitted to the Master’s course you must have:

- Bachelor’s degree (obtained by the enrollment deadline of the round of selection you applied for)

- Excellent level of English

The admission to the Master is subject to the positive evaluation of the selection test in line with the number of places available. The selection, held online, process consists of one Aptitude Test and one English Language Test, both prerequisites to be admitted to the motivational interview in English.

APPLICATION PROCESS

1. Register on “Studenti Online” by connecting to the site studenti.unibo.it

2. Select: First Level Master >Master in Finance

3. Pay the participation fee for the selection (60 euro)

4. Upload the required documents online:

- Curriculum Vitae in English

- Motivational letter in English

- Letters of reference in English (optional)

- Photograph of recognition

- If available, a GMAT/GRE certificate with a score above 550 (GMAT) or equivalent (GRE). Applicants uploading this certificate are exempted from the written aptitude test as part of the admission process

- If available, an English language certificate (TOEFL, IELTS or CAMBRIDGE) attesting a minimum English level of B2 in the European framework. Applicants uploading this certificate are exempted from the written English test as part of the admission process

- For degrees obtained in Italy: Self-certification of Bachelor’s degree with details of exams taken and relative grades

- For degrees obtained abroad: Dichiarazione di Valore (to be requested at the Italian Embassy in the country where the degree was obtained) or Diploma Supplement (to be requested at the university where the degree was obtained). In the event that the candidate is unable to obtain the Dichiarazione di Valore or Diploma Supplement at the time of enrollment, he/she may temporarily replace it with a Conditional Enrollment Form, which will be sent at finance@bbs.unibo.it

For further guidance, candidates who obtained a bachelor’s degree abroad are encouraged to check the page below: https://www.unibo.it/en/teaching/enrolment-transfer-and-final-examination/declaration-of-value-translation-and-legalization

For information regarding the selection process, please download the Call for Application and the related attachements.

CALL_PROFESSIONAL MASTERS CALL_MASTER IN FINANCE INSTRUCTIONS TO APPLY TO THE SELECTION CONCENTRATION FORM CONDITIONAL ENROLLMENT